SUSTAINABILITY REPORT 2023

At Banco Montepio, we view sustainability as more than an objective or regulatory requirement. It is a responsibility to all stakeholders, including the environment.

CEO’s message.

“Our reporting practices prioritise accuracy and transparency to ensure our performance benefits current and future generations. Each year, we add a new chapter to Banco Montepio’s corporate social responsibility storyline.“

Pedro Leitão

Chief Executive OfficerCommitments Driving Us.

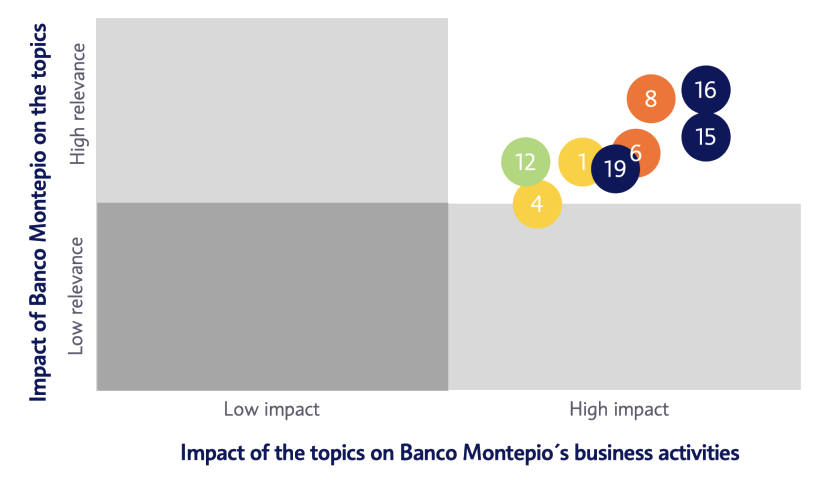

Analyzing the impacts, risks and opportunities of material topics helps to ensure that our sustainability efforts are targeted, informed and effective in responding to the challenges and opportunities we face, together with our stakeholders, adding value to strategic sustainability planning and decision-making processes.

- 1. Financial literacy and inclusion

- 4. “Green” products and services

- 6. Atracting and retaining talent

- 8. Impact investment and Social economy

- 12. Climate action

- 15. Cybersecurity and information privacy

- 16. Corporate governance and ethics

- 19. ESG Risk management

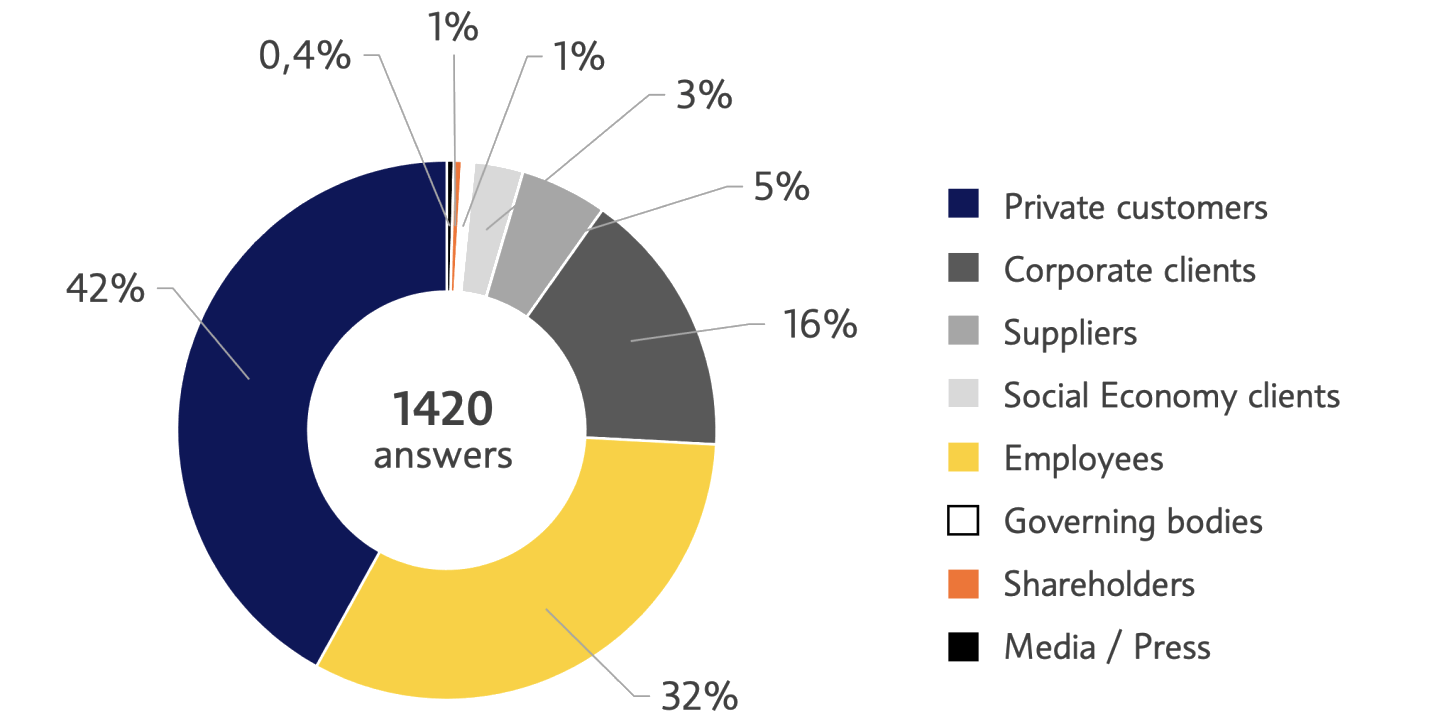

Aggregate participation

Values We Manage.

We recognize our impact on our value chain, so we are committed to ethical governance, to fostering resilience and shared prosperity, and to implementing various initiatives in the field of capital market investment.

Supporting sustainable bond issues.

Sustainability-linked Bond

Mota-Engil 2023-2027

Green Project Bond Blue Future II

2023-2038

Sustainability Bonds José de Mello Capital 2023-2028

Investor and Custodian of the Impact Inovation Fund.

The first Iberian fund for companies, primarily investing in Portugal (>70%), will have an endowment of €25 million, and will invest in companies with potential of becoming global references for their social and environmental solutions.

Calculating the GAR according to the European Taxonomy.

Of the 12 billion assets considered, 62 million are green assets.

*GAR - Green Asset Ratio, in line with the European Taxonomy, we carry out the first calculation of the GAR

Our Created Value.

Financial performance

We monitor socio-economic developments, using our financial performance as a basis for investing in a close relationship with our stakeholders.

€144.5 Mn

(excluding the effect of the reclassification of the foreign exchange reserve) a record level that compares to €33.8Mn in 2022.18.8%

Increase compared to 16.2% in 2022.16.1%

Increase compared to 13,7% in 2022Human Capital

We strive to create a working community that reflects the diverse communities we serve, promoting equality, diversity, and inclusion, on a path of shared success with our people.

*Salary ratio calculated based on the average annual remuneration of women over the average annual remuneration of men, for each professional category

50 %

82%

Gender Diversity Champion with a score of80.3%

*Salary ratio calculated based on the average annual remuneration of women over the average annual remuneration of men, for each professional category

Social Capital

We are recognized as one of the main social economy structures and we contribute to the achievement of social sustainability through the participation of our people and corporate volunteering.

Natural Capital

We recognize that our operations have environmental impacts and so we are gradually integrating environmental considerations into our activities, offers and value chain.

A

Move+ certification from ADENE447 072

the equivalent of 2682 kg of plastic1 194 767

tCO2e2.8%

compared to 2022-9%

Scope 1-54%

Scope 2-4%

Scope 3

Social Impact.

In 2023, we developed a first approach to measuring our social impact, to evaluate and communicate transparently through the different channels we use to support the society. We have adopted a comprehensive methodology of our contributions, calculating our impacts in the following focus areas:

We are aligned to the following Sustainable Development Goals

270.2 M€

loans granted to social economy institutions with a social purpose30 %

HPP credit granted to young clients (<35 years)14 %

to families with income below the national average4.9 M€

to support education, health, and fight social exclusion